The QuickBooks Gal: Bookkeeping, Payroll and More!

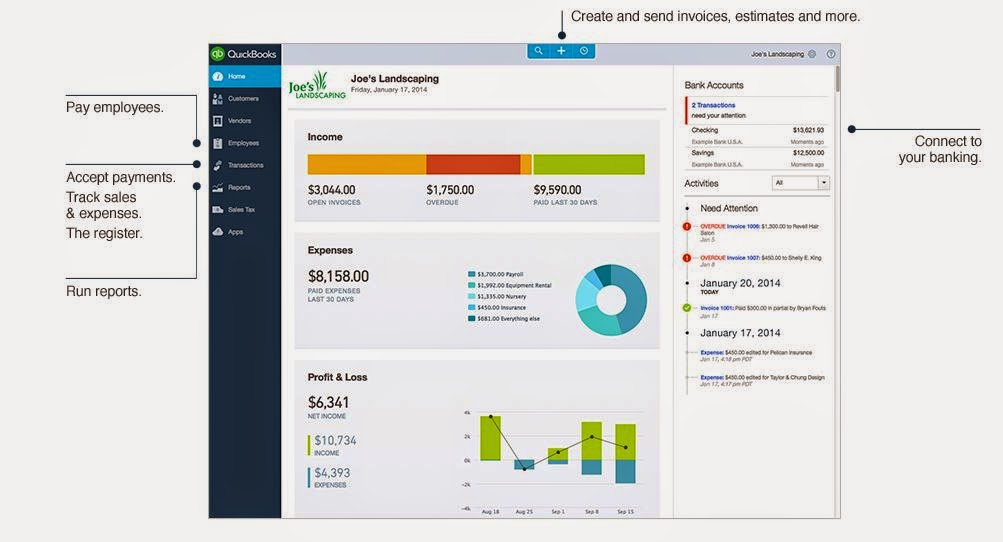

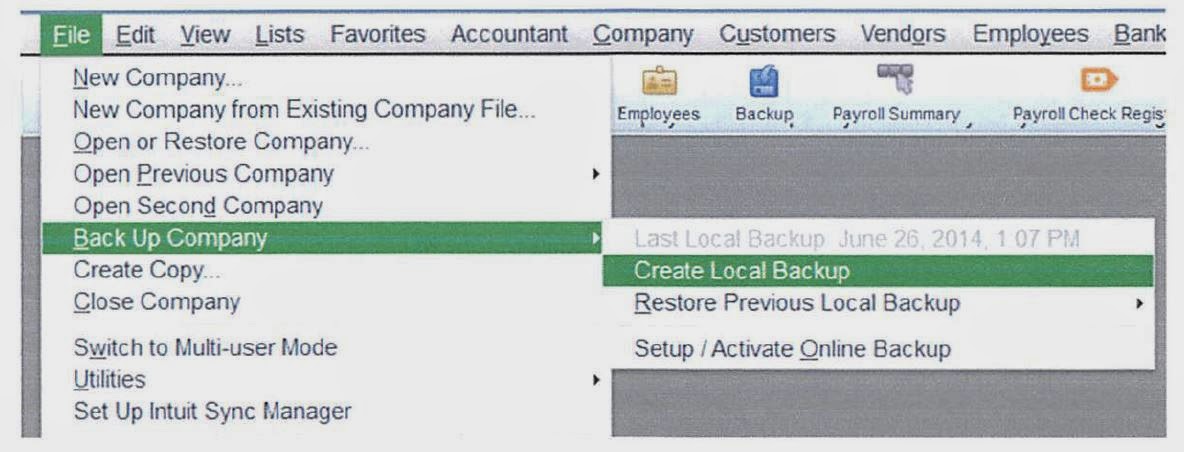

The QuickBooks Gal is here for all your business needs! Our bookkeeping service is suitable for any size business, big or small we have you covered! We Offer: Set up Clean up Ongoing Bookkeeping Process daily sales and deposit reports Verify daily deposits and report variances Reconcile and verify credit card deposits Reconcile monthly bank statements The QuickBooks Gal even does payroll! Which makes running your business a little easier! What Does This Entail? Maintain Payroll Records E-Verify New Employees Process Payroll Direct Deposit Process Governments & Child Support Process Quarterly Tax Reports Process Annual Reports & W-2's The QuickBooksGal even offers remote support services; the latest technologies for screen sharing. Gaining access to your screen allows our experts to view your precise problem and rectify it swiftly. These remote support sessions allow our advisers to troubleshoot QuickBooks issues f...