The QuickBooks Gal: Book Online

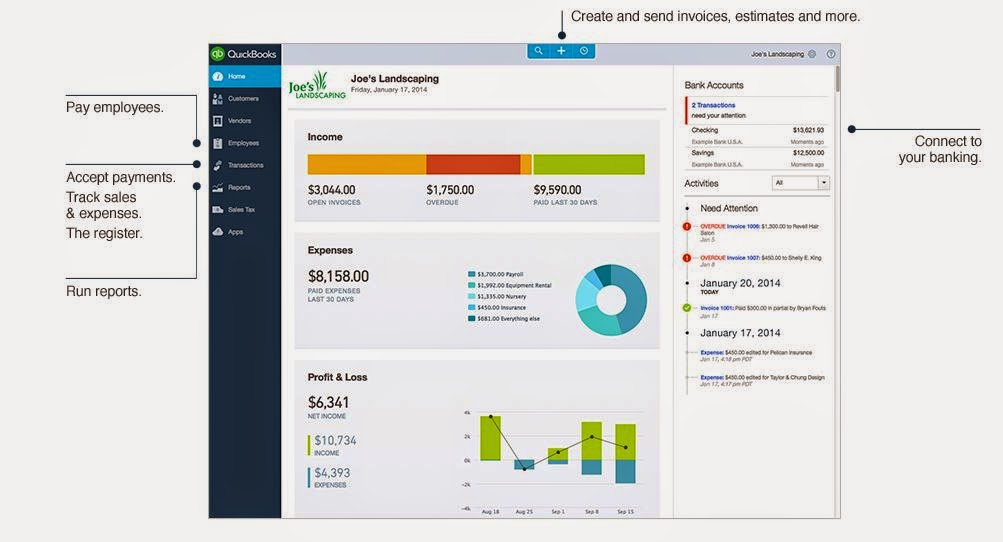

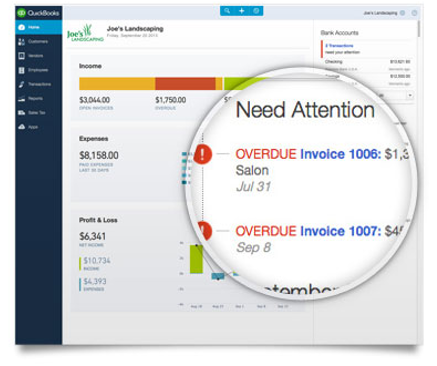

You can now book your appointment online at www.qbgal.com! Just head to the front page and click on 'Book Now' to get started! The QuickBooks Gal is here to help you and your business! Big or small The QuickBooks Gal can help you! QuickBooks: Got a QuickBooks Mess? Call The QuickBooks Gal! The QuickBooks Gal helps with set-up, clean up and more! Bookkeeping: The QuickBooks Gal bookkeeping services are suitable for any industry: aimed towards businesses of small to medium sizes. The QuickBooks Gal takes care of all your bookkeeping needs. Services include: Set up Clean up Ongoing Bookkeeping Process daily sales and deposit reports Verify daily deposits and report variances Reconcile and verify credit card deposits Reconcile monthly bank statements And more! Payroll: The QuickBooksGal will take the hours and rates of your employees and manage them in an orderly fashion. What Does This En...