Quickbooks Format Changes

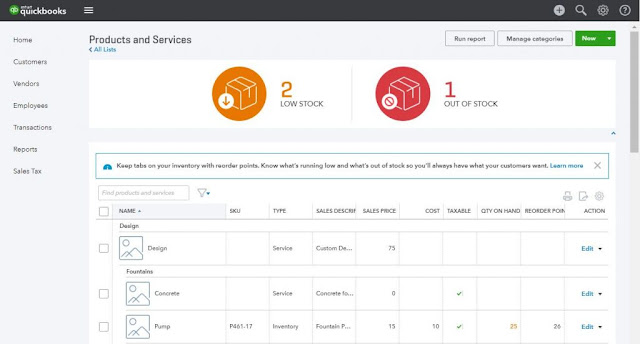

Your clients Quickbooks are changing! Coming soon to Quickbooks, a change in formatting. Originally, your clients displayed a classic form template. In the next couple of weeks, this will be replaced by the standard form template. However, this will be a simple transition! These two formats are very similar and will be easier for you and your client to display information. Quickbooks has also taken the chance to redesign the screen layout for a less cluttered look. They have also added some new sales form styles and custimization options. WIth this new update your clients will be able to: Select from multiple templates with different designs Experiment with various colors within statements Pick from a variety of fonts To make sure the new form meets your needs, theres are many customization options. To open your templates, click the Gear icon > Custom Form Styles . To change the Standard style for all types of forms, click Edit or ...